santa clara property tax exemption

To claim the exemption the homeowner must make a one-time filing with the county. APN for real property in Santa Clara.

Santa Clara County Transfer On Death Affidavit Form California Deeds Com

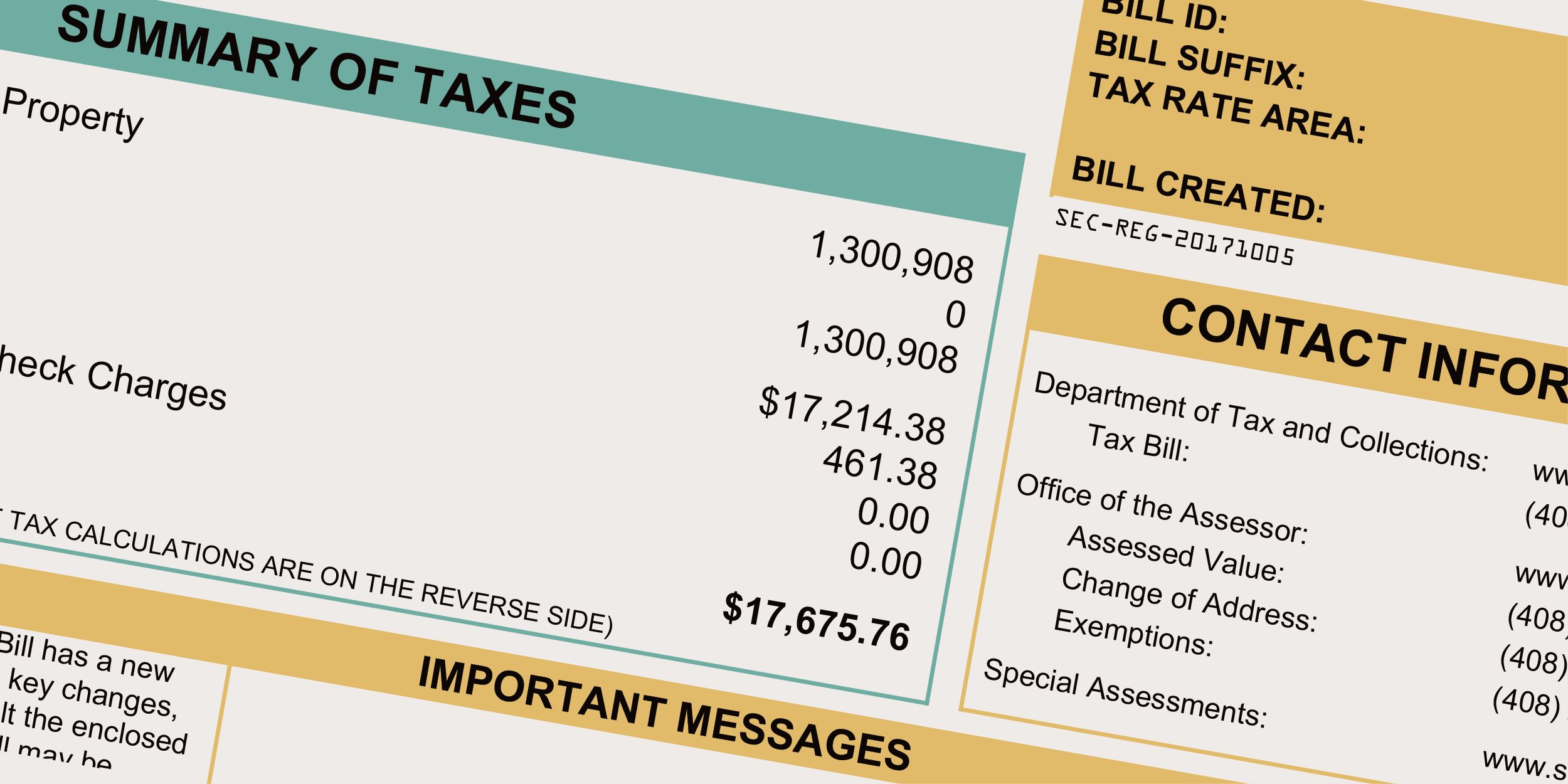

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

. Learn Everything You Need to Know About School Parcel Tax Exemptions in Santa Clara County. Request the Assessor to speak. The application period for the 2022 Low-Income Senior Exemption Safe Clean Water Tax is April 15 2022 - June 30 2022.

Available Exemptions Application DeadlinePeriod Renewal Website for Exemption and Application Information. You may call the Assessors Office at the number below for more specific information. The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence.

100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property. This translates to annual property tax savings of. The home must have been the principal place of residence of the owner on the lien date January 1st.

Santa Clara County Property Tax Exemption Form - Santa Clara County Property Tax Exemption Form - How must a county exemption kind be filled in. Applications for Property Tax Postponement for the 2020-21 tax year are now available. See who is exempt from Special Assessment parcel taxes.

The tax was renewed and approved by the voters in November 2020. Code 27201. This translates to annual property tax savings of.

The bills will be available online to be viewedpaid on the same day. Palo Alto Exemptions Info and Application. Owners must also be given an appropriate notice of rate.

Please call 800 952-5661 or email postponementscocagov if you prefer to have an application. Santa Clara Valley Water District. Assessor Exemptions County Government Center East Wing 5th Floor 70 West Hedding Street San Jose CA 95110 Phone.

The property must be located in Santa Clara County. Property Tax Exemptions. Homeowners can call the Assessors Exemption Unit at 408 299-6460 or e-mail the.

All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. Special Assessments are taxes levied for specific projects and services. Senior citizens and blind.

For More Information Please Contact. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to. The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence.

28 rows Cambrian Exemptions Info and Application. Parcel taxes are real property tax assessments available to cities counties. Franklin-McKinley Exemptions Info and.

CC 1169 The document must be authorized or required by law to be recorded. Email the Assessors Office.

Assessor Santa Clara County California Primary Election Ballot Voter Guide Tuesday June 7 2022 Voter S Edge California Voter Guide

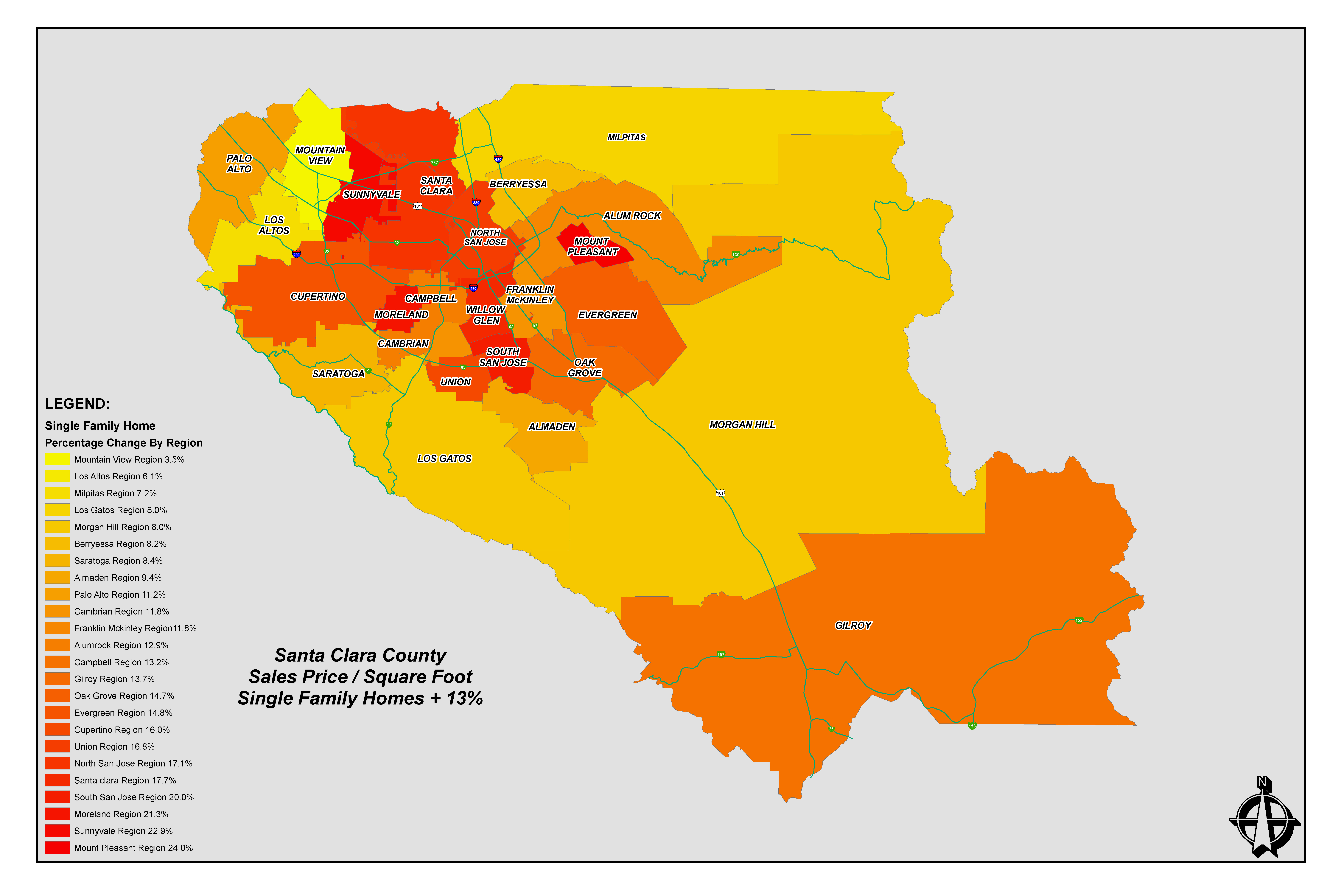

Single Family Home Values Up 4 To 24 Condominiums Up 13 To 46

Santa Clara County Office Of The Assessor Facebook

Santa Clara Mayor School District May Have Skirted State Labor Laws Campbell Ca Patch

Santa Clara County Transfer Tax Affidavit Fill Out Sign Online Dochub

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Santa Clara River The Nature Conservancy In California

Adu Summit 2021 How Adu And Prop 19 Will Affect Your Property Tax County Assessors Youtube

Official Map Of The County Of Santa Clara California Compiled From U S Surveys County Records And Private Surveys And The Tax List Of 1889 By Order Of The Hon Board Of Supervisors

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Santa Clara Property Records Fill Online Printable Fillable Blank Pdffiller

Property Owners In Santa Clara County Are Eligible For Tax Bill Relief

Santa Clara County Office Of The Assessor Facebook

How Has Prop 13 Affected Tax Distribution In Santa Clara County San Jose Spotlight

Letter To Kaiser Permanente The County Of Santa Clara Public Health Archives Santa Clara County Board Of Supervisors

Business Owners Efile Property Statements

County Of Santa Clara On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future

Stanford Wants Educational Tax Exemption For Faculty Homes News Almanac Online

Property Taxes Department Of Tax And Collections County Of Santa Clara